|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Where to Refinance My Home Loan: Exploring the Best Options and OpportunitiesRefinancing your home loan can be a strategic move to improve your financial situation. Whether you're looking to lower your interest rate, reduce monthly payments, or tap into your home equity, knowing where to refinance is crucial. Understanding Refinancing BasicsBefore diving into where to refinance, it’s essential to understand what refinancing entails. Refinancing involves replacing your existing mortgage with a new one, typically to secure better terms or cash out equity. Types of Refinancing

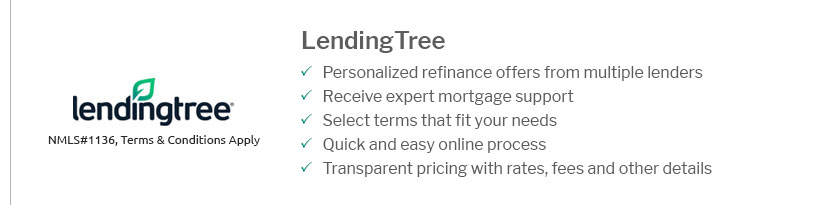

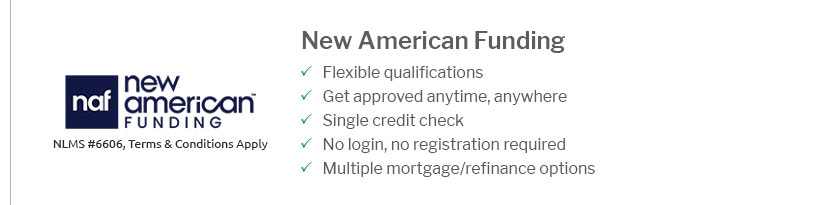

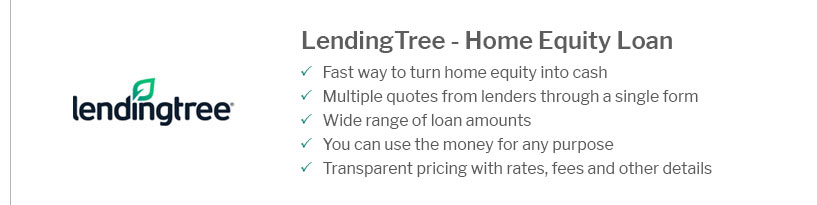

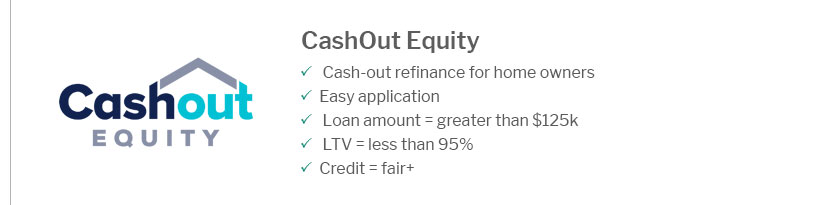

Top Places to Refinance Your Home LoanWhen considering where to refinance, you have multiple options, each with unique benefits. Banks and Credit UnionsBanks and credit unions are traditional choices for refinancing. They often provide personalized service and competitive rates, particularly for existing customers. Consider checking the cash out refi rates offered by these institutions to evaluate their suitability. Online LendersOnline lenders can offer convenience and speed, often with lower overhead costs translating to better rates. These platforms provide tools for easy rate comparisons, making them an attractive option for tech-savvy homeowners. Mortgage BrokersMortgage brokers act as intermediaries between you and potential lenders, helping you find the best refinancing deal based on your needs. They have access to a wide network of lenders, which can be advantageous if you're looking for specialized loans like an fha first time home buyer loan. Factors to Consider When RefinancingSeveral factors should guide your decision on where to refinance your home loan. Interest RatesOne of the primary reasons homeowners refinance is to secure a lower interest rate. Even a small reduction can lead to significant savings over the life of the loan. Loan TermsAdjusting the loan term can help you pay off your mortgage sooner or reduce your monthly payments, depending on your financial goals. Fees and CostsRefinancing involves certain costs, including application fees, appraisal fees, and closing costs. It’s essential to weigh these against potential savings. FAQs About Refinancing Home LoansWhat is the best time to refinance my home loan?The best time to refinance is when interest rates are lower than your current rate, and you plan to stay in your home long enough to recoup the closing costs. Can I refinance with bad credit?Refinancing with bad credit is possible but may involve higher interest rates. Some lenders specialize in working with borrowers with less-than-perfect credit. How often can I refinance my home loan?There is no legal limit to how often you can refinance, but it’s important to consider the costs and your long-term financial strategy. https://www.cnbc.com/select/best-mortgage-refinance-lenders/

Refinancing your mortgage can get you better terms and even access to cash. - Best mortgage refinance lenders - Best for low rates: Better - Best for online tools: ... https://www.lendingtree.com/home/refinance/

Refinancing your mortgage means replacing an existing home loan with a new one. You usually follow the same steps you did to apply for your purchase mortgage, ... https://planethomelending.com/refinance-mortgage/

Your Refinance Professional stays on call to answer your questions throughout the process. Call 888-966-9044 or sign up to ...

|

|---|